THERMOMODERNISATION ALLOWANCE - EXAMPLE OF SETTLEMENT

The thermal modernisation allowance is gaining popularity among single-family homeowners as a method for a significant tax return and an incentive to invest in renewable energy sources and better air quality by reducing harmful emissions. For the 2023/2024 tax year, both the maximum amount of the relief, which is PLN 53,000 for one person, and the rules for accounting for it have not changed compared to previous years. Nevertheless, it is worth bearing in mind that these rules may be updated in light of new tax regulations, so it is recommended to keep up to date.

Thermal modernisation allowance - what it is

The thermomodernisation allowance in Poland is a form of tax support for individuals who invest in improving the energy efficiency of their single-family houses, flats or other residential buildings. The purpose of the relief is to encourage investments to improve energy efficiency, which translates into lower energy consumption and reduced emissions of harmful substances into the atmosphere.

You can benefit from the thermal modernisation allowance by making certain expenditures for thermal modernisation projects. Such expenses include:

- Upgrading or replacing the heating system.

- Thermal insulation of the building (e.g. insulation of walls, roof, replacement of windows and doors with more energy-efficient ones).

- Installation of systems using renewable energy sources (e.g. installation of photovoltaic or solar panels).

- Other construction and installation work that contributes to the energy efficiency of the building.

The maximum amount of the relief that can be used within one tax year is PLN 53 000 per person. This relief allows the expenses incurred to be deducted from the tax base, which in practice means a reduction of the income tax due. It is important to accurately document all investments and expenses related to thermo-modernisation, as these are necessary to benefit from the relief in the annual return.

Thermal modernisation allowance - who can benefit

In Poland, the thermomodernisation allowance can be used by individuals who make investments related to energy efficiency improvements in:

- single-family houses, regardless of whether they are owners, co-owners, perpetual usufructuaries or holders of self-contained dwellings,

- dwellings in multi-family buildings,

- residential buildings owned by a housing cooperative or housing association, provided that the investment concerns the common parts of the building.

In order to qualify for the relief, the investments must be related to the implementation of thermal modernisation projects to improve the energy efficiency of the building.

The thermo-modernisation allowance is settled on the the following forms:

- PIT 37 and PIT 36 (tax scale)

- PIT - 36L (flat tax)

- PIT - 28 (flat rate)

Thermal modernisation allowance - what can be deducted

This includes a range of activities such as:

- Insulation of the building - expenditure on materials and work related to the thermal insulation of external walls, the roof, the floor on the ground or the ceiling over an unheated attic.

- Replacement of windows and doors - the costs of purchasing and installing new windows and external doors with improved thermal insulation.

- Heating system modernisation - expenditure on replacing or modernising the existing heating system with a more efficient one, including the installation of heating systems using renewable energy sources (e.g. heat pumps, biomass boilers, solar panels).

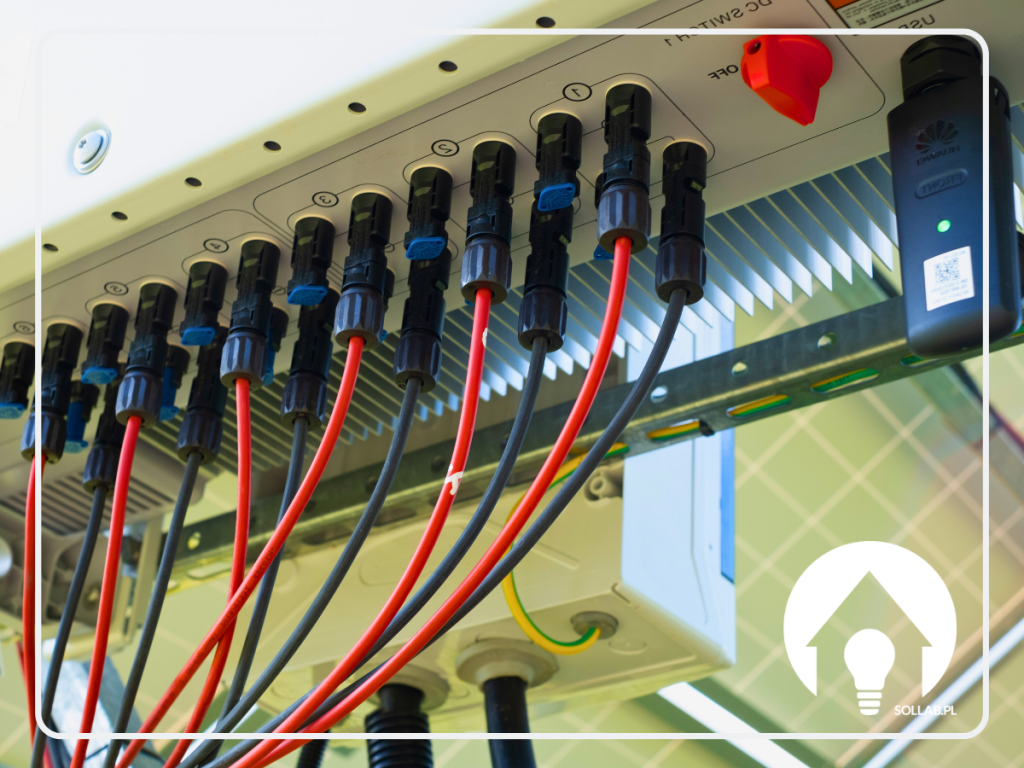

- Installation of systems using renewable energy sources - costs associated with the installation of photovoltaic panels, solar thermal collectors for the production of domestic hot water or other systems for obtaining energy from renewable sources.

- Installation of mechanical ventilation with heat recovery - expenditure on ventilation systems that enable more efficient energy management in the building.

- Insulation of heat pipes - the cost of materials and work to insulate pipework and heat pipes, which reduces heat loss.

- Modernisation of lighting - spending on energy-efficient lighting systems, including LEDs, which help to reduce electricity consumption.

- Automation and control - the costs associated with installing modern energy management systems in the building to enable more efficient use of energy.

- Energy audit - expenditure incurred in carrying out an energy audit prior to the commencement of thermo-modernisation investments, which is necessary to qualify for the relief.

In order to benefit from the relief, it is necessary to properly document the expenses incurred.

THERMOMODERNISATION ALLOWANCE - EXAMPLE OF SETTLEMENT

Below you will find two examples of the application of the thermal modernisation allowance for investments in a photovoltaic installation and a photovoltaic + heat pump installation.

1 An example of the settlement of the thermo-modernisation allowance for a single-family house owner who has invested in a photovoltaic installation worth PLN 37,000 in 2023 is as follows:

Investment cost: £37,000 - this amount includes the purchase and installation of photovoltaic panels.

Maximum amount of relief: Expenditure up to a maximum of PLN 53,000 per person can be used for the thermal modernisation allowance deduction. In this case, the entire investment of PLN 37,000 is eligible for deduction as it does not exceed the maximum limit.

Deduction from income: The thermal modernisation allowance allows expenses incurred to be deducted directly from income, meaning that the amount of £37,000 will be deducted from the homeowner's total income earned in 2023.

Calculation of relief: Assuming that the homeowner has an income of PLN 100 000 in 2023, the value of the investment in the photovoltaic installation, i.e. PLN 37 000, can be deducted from this amount. This means that an income of PLN 63 000 remains to be taxed.

Tax effect: By applying the thermal modernisation allowance, the taxpayer reduces his or her tax base, which translates into lower income tax to be paid. The final amount of tax saved will depend on the applicable tax rate. There are two PIT rates in Poland: 17% and 32%. Depending on the homeowner's income and tax situation, the real tax saving will result from the tax rate applied to the reduced tax base.

This example shows how the use of the thermal modernisation allowance can bring tangible financial benefits by reducing the tax burden. However, it is important to remember to keep all invoices and supporting documents for the expenses incurred, as these are necessary to benefit from the relief in the annual return.

(2) If the owner of a single-family house has invested in a photovoltaic installation and a heat pump in 2023 and the total value of these investments amounted to PLN 70,000, the settlement of the thermal modernisation allowance is as follows:

Investment cost: £70,000 - total expenditure for the purchase and installation of a photovoltaic system and heat pump.

Maximum amount of relief: Under the thermal modernisation allowance, expenses up to a maximum of PLN 53,000 per person in a given tax year can be deducted. The value of the investments made (PLN 70,000) exceeds this limit, but the maximum amount that can be deducted is precisely PLN 53,000.

Deduction from income: The relief allows a deduction of up to £53,000 directly from the taxpayer's income in the year in which the expenses are incurred.

Calculation of relief: Let us assume that the homeowner's income in 2023 was PLN 120 000. Thanks to the thermo-modernisation allowance, an amount of PLN 53 000 can be deducted from this income, which means that an income of PLN 67 000 will remain to be taxed.

Tax effect: The application of the thermal modernisation allowance will reduce the tax base, which translates into lower income tax to be paid. The tax saving depends on the applicable tax rate. There are two PIT rates in Poland: 17% and 32%. Applying the 17% rate to the reduced tax base means that the tax saving will be PLN 9,010 (PLN 53,000 * 17%).

In summary, an investment in a photovoltaic installation and a heat pump for a total of PLN 70 000 allows for a maximum deduction under the thermo-modernisation allowance of PLN 53 000 from income, resulting in a reduction of the tax base and tax savings. However, it is worth remembering that exceeding the maximum amount does not allow the excess expenditure to be carried forward to the next tax year. It is also important to keep all documents confirming the expenses incurred in order to be able to properly benefit from the relief.